Long term capital gain calculator

The tax rate on most net capital gain is no higher than 15 for most individuals. For example if you bought art in January 2021 and sold it in January 2031 which is after longer than 1 year you will have to pay long-term capital gains tax on any profits.

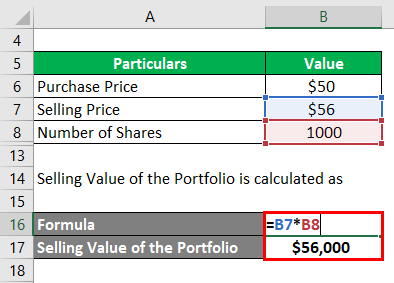

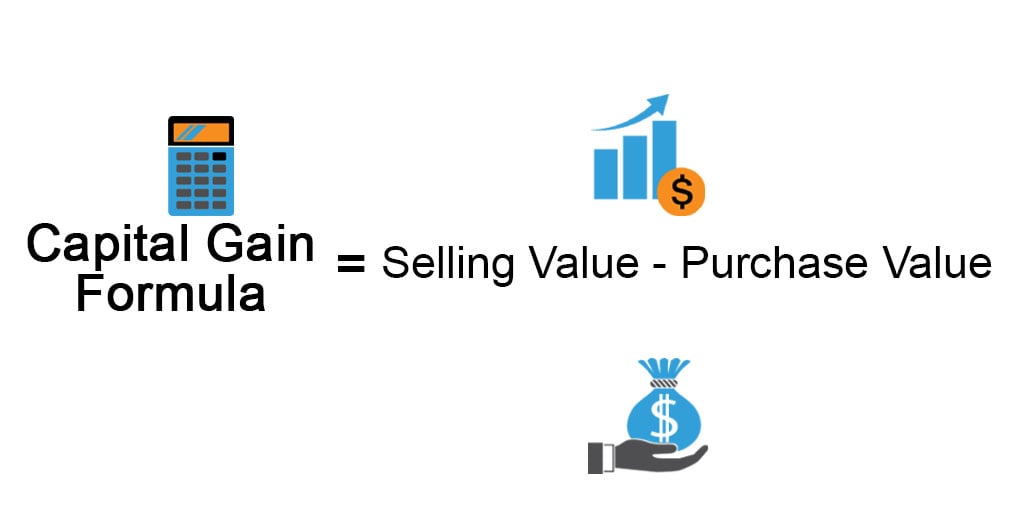

Capital Gain Formula Calculator Examples With Excel Template

Tax on Long-term Capital Gain.

. For instance if Mr A bought gold for Rs 25 lakh in 2015 and sold it for Rs 275 lakh in 2016 his capital gain will be. There are also special cases when an individual is charged at 10 on the total capital gains. He also has Rs 50000 as Income from Other Sources.

Illustration of long term capital gains tax in India Equity oriented mutual funds Long Term Capital Gains. In other cases which are not covered by Section 1038 ie. Long-term capital gains result from selling capital assets owned for more than one year and are subject to a tax of 0 15 or 20.

The applicable tax on STCG is different for different assets. Mr X bought equity shares on 15th Dec 2016 for Rs. What is Short-Term Capital Gain on Shares.

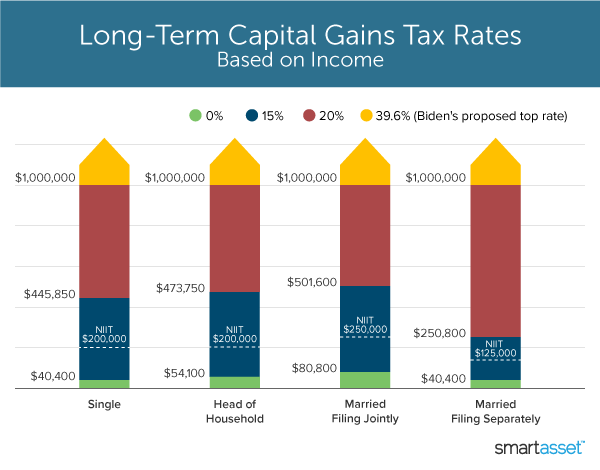

Long-Term Capital Gains Tax Rates. In the case of shares a short-term capital gain arises when shares are sold within 12 or 24 months from the date of purchase. Points to be noted-.

He sold the shares on 10th May 2018 for Rs. Support person X purchases a total of 200 shares of XYZ company at the rate of 1000 per share in 2018 May. Use the same process to.

Any LTCG exceeding Rs 100000 arising on sale of equity-oriented mutual funds will be liable to tax 10 provided securities transaction tax has been paid. Cost of Acquisition COA Higher of. The long-term capital gain tax rate is usually calculated at 20 plus surcharge and cess as applicable.

A capital gain arising from the sale of a short-term capital asset is a short-term capital gain. Any type of capital asset can result in a short- or long-term capital gain. Exemptions on Long-Term Capital Gain on a Property In 2022 Taxes tend to reduce the bulk of gains earned by an individual.

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. Typically there are specific rules and different tax rates applied to short-term and long-term capital gains. These situations include Long-term capital gains earned by selling listed securities of more than Rs.

The capital gains tax is economically senseless. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. This is why the Income Tax Department of India has made several tax provisions which help individuals lower their tax.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Weve got all the 2021 and 2022 capital gains tax rates in one. In general you will pay less in taxes on long-term capital gains than you will on short-term capital gains.

As the long-term capital gain is exempted from tax so long-term capital loss shall have no tax treatment and such long-term capital loss cannot be set-off against any income nor be carried forward to next year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. The long-term capital gains tax rate is usually 0 15 and 20 depending on your income and filing status.

12000 as on 31st Jan 18. However the income thresholds rise each year due to inflation adjustments. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty.

What will be the long-term capital gain loss. FMV of the shares was Rs. Listed shares on which STT is not paid the amount of long-term capital gain shall be taxed under.

Capital Gain Tax Rates. The term net long-term capital gain means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years. Calculate STCG Tax applicable.

Guide to Filing Your Taxes in 2022. Our calculator can be used as a long-term capital gain. For example short-term capital losses are only deductible against short-term capital gains.

The gain on a depreciable asset is always taxed as short term capital gain. Capital Gain Loss Sale Price Revised Cost of Acquisition on 3112018. Capital assets include stocks bonds precious metals jewelry.

Investments can be taxed at either long term capital gain tax rate or short term. The working of the long-term capital gain LTCG calculator is pretty simple and let us understand the same with the help of an example. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

Multiple ways are available to. Some or all net capital gain may be taxed at 0 if your. CALCULATING LONG-TERM SHORT-TERM CAPITAL GAINS Short-term capital gain The gain from transfer of a short-term capital asset.

Additionally you can only deduct up to 3000 of net long-term capital losses in a given tax year. For example you might have realized 500 in profit on one long-term holding while losing 200 on another which would result in a net 300 long-term gain for the year. Tax will be applicable on a short-term capital gain of Rs 3 lakh Rs 4 lakh Rs 1 Lakh at a flat rate of 15.

Likewise capital losses are also typically categorized as short term or long term using the same criteria. Any excess net long-term capital losses can be carried forward until there is sufficient capital gain income or the 3000 net long-term capital loss. The tax rates for long-term capital gains are the same for the 2021 and 2022 tax years.

Ajay has a taxable salary income of only Rs 1 lakh and a short-term capital gain on the sale of equity shares of Rs 4 lakh. Now suppose in 2020 January Mr X sold the 200 shares at the rate of 1800. You can also calculate the capital using Scripboxs Capital Gain Calculator.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Tax Calculator Estimate Your Income Tax For 2022 Free

Long Term Capital Gain Tax Calculator In Excel Financial Control

Capital Gains Tax What It Is How It Works Seeking Alpha

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Capital Gains Tax What Is It When Do You Pay It

Sale Of Under Construction Property How To Calculate Capital Gains

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Short Term Vs Long Term Capital Gains White Coat Investor

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Long Term Capital Gain Tax Calculator In Excel Financial Control

What S In Biden S Capital Gains Tax Plan Smartasset

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Capital Gains Tax Calculator The Turbotax Blog

Capital Gain Formula Calculator Examples With Excel Template